The Hull-White model (1990), an interest rate model, is a yield-based no-arbitrage model. This is extension of the Vasicek model. The model allows closed-form solutions for European options on zero-coupon bonds.

TheoV

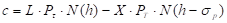

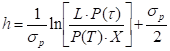

Call

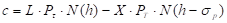

Put

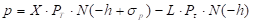

Where

L – bond principal (i.e. face value),

τ – bond time maturity,

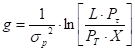

,

,

,

,

P(T) - the price at time zero of a zero-coupon bond that pays $1 at time T,

a – the speed of the mean reversion.

Unlike Vasicek model, PT and Pτ are input parameters.

Delta

Call

Put

Gamma

Gamma is identical for put and call options.

Vega

Because

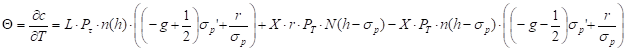

Theta

Call

Put

where

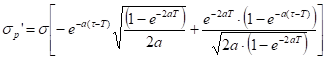

Rho

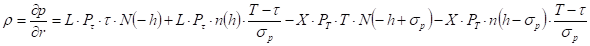

Since, the price at time zero of a zero-coupon bond that pays $1 at time t is

then

then

Call

Put

Implied volatility

The system finds implied volatility numerically.